Contents:

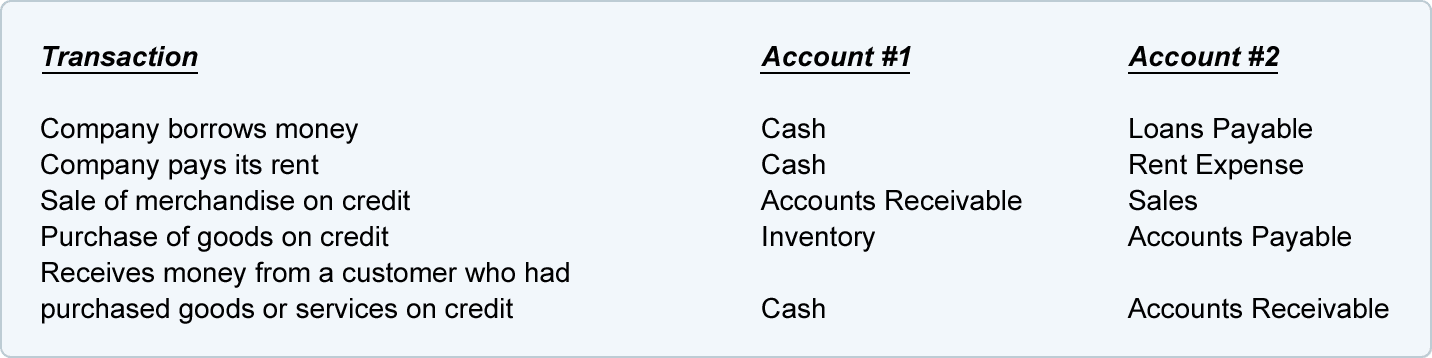

The double calendar spread normally covers a wider space as the trade can be profitable if the price remains between the two tents. With the same premiums, a calendar spread trade will cover a smaller area. A double calendar spread can be useful when you expect the underlying stock to trade in a range, with little or no movement. In terms of vertical spreads, everything is the same except the strike prices.

This sort of shape results in high gamma near expiry which we’ll look at in more detail shortly. The market was underwhelmed by the release and I exited both sides on the close of the 27th. Transaction charges, STT/CTT, stamp duty and any other regulatory/statutory charges will be levied in normal course for all trades. Nonetheless, there is a theoretical way where we can assume all things remain equal to calculate the maximum loss possible. The ideal situation is when you can square off the position before the expiry.

Option Alpha calculates probabilities for millions of potential options positions using live market data so you can find new ideas without the guesswork. A calendar spread takes advantage of the pricing differential that may start to develop between a front month option and a back month option. Assignment by itself is not a bad thing – unless it causes a margin call and forced liquidation. Worst case scenario, the broker will liquidate the shares in pre-market, the stock will rise between the liquidation and the open and the puts will be worth less. Otherwise, you are 100% covered – each dollar you lose in the stock you gain in the options. For reasons that I don’t understand many rookie option traders fear being assigned an exercise notice on a previously sold option.

When the front month expires, assuming FAHN is still within the strike range, they’ll sell another short-term strangle and repeat the process. Keep in mind that multi-leg and rolling options strategies can entail additional transaction costs, including multiple commissions and contract fees, which may impact any potential return. Photo by tommao wang on UnsplashThis article discusses how traders can earn side hustle income trading double calendar spreads. A double calendar spread is essentially just two calendar spreads with different strike prices. Pre-earnings calendars use short options expiring few days after earnings. The idea is that for some stocks, the short term options will lose value faster than the longer term options, causing the calendars to widen.

Double Calendars: The Low Volatility Trade with Two Peaks

Calendar spreads are best suited during periods of low to high volatility. How much money do I need to be efficient and effective following your instructions? I could really benefit from extra income but I am also in a position where I can’t really afford to lose much so there is some doubt/fear. But, your information and attitude felt right to me so I reached out.

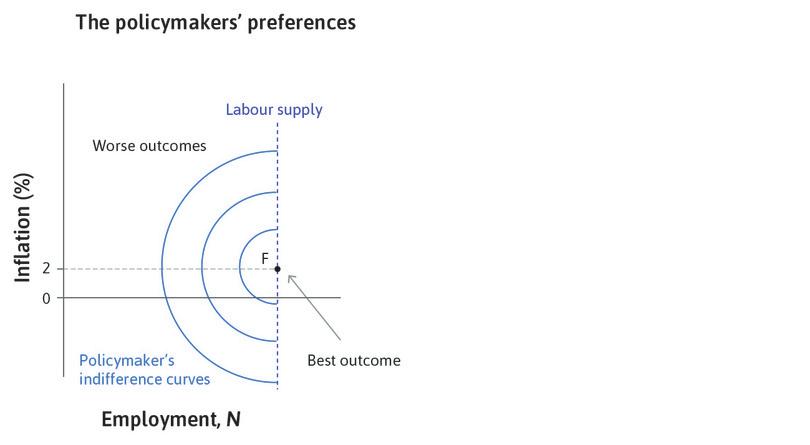

The 140 is the high watermark, and the profit potential begins to fade as soon as FAHN deviates from 140. By the time it’s moved $5 one way or the other, you’re below the break-even point. But if you’re looking to spread out that risk, you might consider a double calendar. The point of all calendar spreads is to profit from increases in implied volatility over time. From that point on, the long-term option can have a potentially unlimited profit, provided it moves in the direction the trader predicted when constructing the spread. In this sense, the premium from the short-term option offsets the cost of the long-term option, reducing the overall cost of the trade.

How to Calculate Break Even Prices for Option Strategies

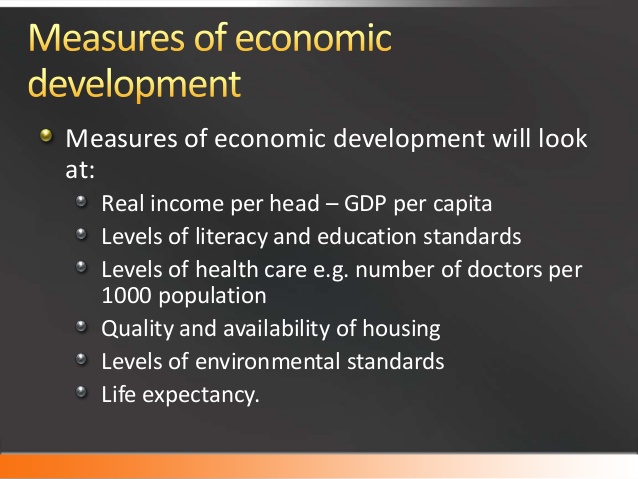

The purpose of the trade is to profit from the passage of time and/or an increase in implied volatility in a directionally neutral strategy. The ideal setup is when the implied volatility in the front month options is significantly higher than the options in the back month; thereby selling higher volatility and buying lower volatility. A double calendar spread gives a trader extra legroom as compared to a trader taking a calendar spread, albeit on the deployment of a higher margin.

In most cases, calendar spreads are used by more experienced investors due to the complexity of the strategy. A calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike price, but for slightly different expiration dates. The last risk to avoid when trading calendar spreads is an untimely entry. Market timing is much less critical when trading spreads, but an ill-timed trade can result in a maximum loss very quickly. A wise trader surveys the condition of the overall market to make sure they are trading in the direction of the underlying trend of the stock.

Often, the resources, tools and research materials a broker makes available to you are instrumental in helping you execute profitable trades. Likewise, if the event you’re expecting to produce enhanced volatility later on fails to do so, you may find yourself holding options without much in the line of upside. With an ever increasing list of financial products on the market, we don’t cater to every single one but we do have expansive coverage of financial products. Today try to manage in the morning, then surrendered and exited all positions. We never allocate more than 5% to any one trade, and usually, we are in the 1%-3% range.

Calendar Spread Definition

A trading signal is triggered when the difference between the two contracts move to mean plus or minus 1 standard deviation and the trade is closed when the difference collapses to mean. Finally, the strategy can be useful when you want to limit your risk while still having the potential to profit from time decay and volatility changes. The payoff diagram on June 12th shows that both the expiration curve and the T+0 line had risen due to a rise in implied volatility in both the short and the long options.

Of course $650 is a bit extreme move in one https://1investing.in/, but you get the idea. The goal is to profit from the difference in time decay between the two options. Let’s go through a couple of examples of calendar spreads and see how they progressed over the course of the trade. If the stock reaches the break even price and my stop loss has not been hit, I like to add a second calendar to turn it into a double calendar. Lots to consider here but let’s look at some of the basics of how to manage calendar spreads. Calendar spreads are considered lower risk than a short straddle because the losses are limited to the premium paid for the spread whereas a short straddle has potentially unlimited losses.

This is because, all else equal, the futures price of Near month contract is always higher than the previous month contract owing to the ‘cost of carry’. The maximum loss is limited to the premium paid to enter the trade, but the maximum gain is unknown because of changes in implied volatility. Notice that the delta hasn’t change but vega has change from -133 to +18 and theta has increased from 54 to 74. We have reduced our volatility risk and added to our time decay. Double calendars also have a profit tent at the short strikes whereas iron condors do better when the stock stays well away from the short strikes.

- A double calendar spread can be useful when you expect the underlying stock to trade in a range, with little or no movement.

- Calendar spread options can be done with calls or with puts, which are virtually equivalent if using same strikes and expirations.

- Essentially you have increased your odds of winning the position.

Let me share with you exactly what I’m watching for when I set up a double calendar. Calendar spreads have less risk but also less profit potential when compared with short straddles and are also positive vega rather than negative vega. The increase in implied volatility in the back-month helps to offset any negative effects from time decay. The Profit & Loss of the calendar spread can be visualized by looking at the P&L of the components over time.

We look to higher double calendar spreads with calls when we have a bullish assumption and we look to lower strikes with puts if we have a bearish bias. A calendar spread profits from time and implied volatility of the options or futures contract value. In essence, if a trader is selling a short-dated option and buying a longer-dated option, the result is a net debit to the account. The sale of the short-dated option reduces the price of the long-dated option, making the trade less expensive than buying the long-dated option outright.

The ideal situation is in a low implied volatility environment. The calendar spread is created with the intention of profiting from the passage of time and/or an increase in implied volatility . The strategy seeks to take advantage of the underlying trading at or near the strike price, with the highest potential for profit occurring in a rising volatility environment. As in how would you buy/sell sbin current month contract on last day of expiry and then carry to next day. Like in eg of sbin we are buying current month contract on 31st August which will close that same day..but technically above we are closing on 1st sept..

By the way, if you are not familiar with what I’m discussing, then I’d suggest you read Chapter 10 in the Futures Trading module to get a quick perspective on the classic calendar spreads approach. I think it forms a crucial foundation on top of which you can build other variant/styles of calendar spreads. The farther apart double calendar with the $160/$210 strikes has a net debit of $2195. In other rare cases I might add a third calendar spread to widen out the profit zone, provided it’s within my plan to add more capital to the trade. If the stock reaches the break even price and my stop loss has not been hit, I usually move the whole double calendar or just once side depending on the situation.

Leave A Comment